FEATURED MEDIA

INTERVIEWS

INSIGHTS

Remember that line from the Wizard of Oz when Dorothy, the Tin Man, the Cowardly Lion, and the Scarecrow are confronting what they think is the Wizard with the loud, booming voice and the smoke swirling around the image? Then Toto, Dorothy’s dog, pulls the curtain aside exposing the fake wizard with his machinery and projection equipment. The wizard says the famous line in an inept attempt to distract the others from the reality of who he is.

A quote that summed up to me the power of investing in real estate comes from Andrew Carnegie. Mr. Carnegie is rated as the third wealthiest individual in our modern economic era that goes back to the dawn of the industrial revolution in the 19th century. He advised that “Ninety percent of all millionaires become so through real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of today invests his money in real estate.”

When people think of investing in real estate, it’s the traditional approach that comes to mind. You own a piece of land or a building that you are renting or leasing. Here, we are going to look at a new type of investing in the real estate market that owes its existence to the technology of the 21st century.

I find it essential to remind people why investing in real estate is a great choice. As you read these articles, you can see the different ways real estate could be a consideration as an investment choice for you. Here, I want to go through a few more advantages of real estate as compared to investing in something like the stockbroker.

Real estate is the correct path to becoming a millionaire. For centuries, we have learned to look up at the buildings around us and see opportunities to invest in each of them and to look at the wonderful beauty and exciting chance to enjoy a higher rate of return, a more tangible investment, and immediate diversification.

Depending on your investment goals, you know there is a great deal of work that goes into your final decision. For most, it comes down to the goal you want to realize based on how much money you have to invest, either in one lump sum or capital you invest on a periodic basis like every month or every paycheck.

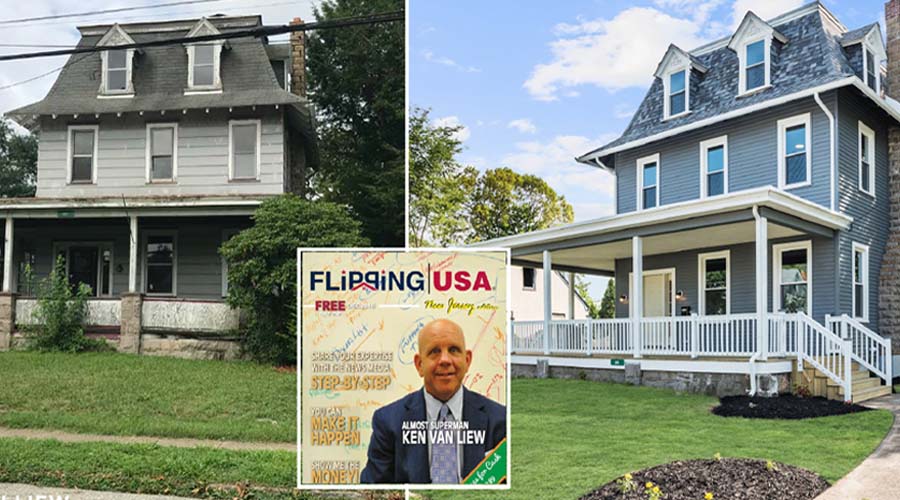

There are different ways of approaching buying and selling real estate. As with any investment, you have to determine which one or what combinations of investing methods work for you. What I want to do is lay some of the different techniques out to enable you to decide what sounds appropriate for your comfort level. While something might not seem like it is right for you now, be open to the future as you gain more success and experience.

For novice and veteran investors alike, anxiety is part of any investment. Quite often, as soon as you make a significant investment, buyer’s remorse can set into your mind. Questions start buzzing around in your head like, “Should I have put money into this?” “Did I do enough research?” “Will a hiccup in the economy affect the investment?” “Am I going to give all of my gains back in taxes?”

Let’s look at the Modern Dynamic Matrix, a customized real estate approach and strategy for you, whether you are just getting started or want to take your portfolio to the next level. The Modern Dynamic Matrix is not an array of numbers, symbols, or expressions arranged in rows and columns. Instead, it’s an array of the types of real estate investing you have available to you, as well as the levels in which you might want to participate in them.

When you talk about retirement to those nearing that milestone, you usually have two reactions – a satisfied smile or a look of fear. The majority will have fear in their eyes. The ones smiling are the minority in America who feel they have a nice nest egg tucked away and continually growing to meet their needs in the golden years. The others know that with their current situation, they are going to retire with very little money, if any at all. CNBC.com reports that 65 percent of all Americans save little or nothing.