There are different ways of approaching buying and selling real estate. As with any investment, you have to determine which one or what combinations of investing methods work for you. What I want to do is lay some of the different techniques out to enable you to decide what sounds appropriate for your comfort level. While something might not seem like it is right for you now, be open to the future as you gain more success and experience.

Before we move onto some advanced methodologies of real estate investing, we need to look at some basic ways it is done. In the traditional approach, you start at the bottom of the real estate pyramid with bird-dogging, then you move to wholesaling, fix and flipping, and finally investing in a multi-unit/commercial. Just like a dog trained to retrieve birds, bird-dogging in real estate is being trained to find deals.

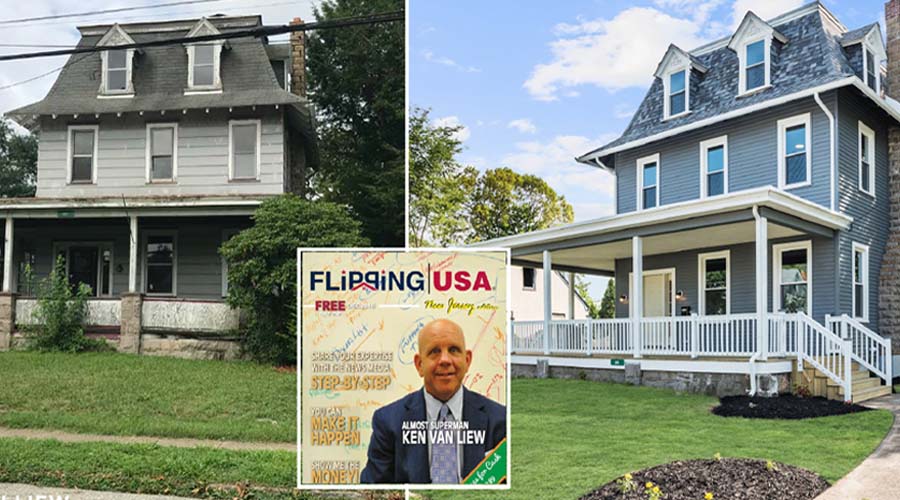

Wholesaling—also known as quick-turn—and fix and flip are two areas of real estate investing you are likely most familiar with as they are the real estate buzz on the street (along with foreclosures, short sales, etc.). An insane number of competitors are clustered in flipping and wholesaling, as I know well from my previous experience as principal and CEO at Flipping NJ.

In wholesaling, you take control of a deal in the form of a contract—typically done for a few dollars—in which you assign the contract to another buyer for a higher price. You earn the spread in the prices, from contract price X to the quick-turn price Y on the assignment agreement. You’ll often find a ready and willing buyer (many cases a fix & flipper), allowing you to make a quick profit with literally none of your money invested. For example, on a wholesale deal, if you lock up and control it for the contract price of $125,000, and then a sell in a quick-turn assignment agreement for $152,000, you would earn $27,000 in profit. Now, take a look at the return on your investment, as it’s not something you want to share with everyone.

Assuming you locked up the deal for 10 percent of the contract price, that’s $12,500. This ties up your money for a short period, only until the assignment buyer replaces your down payment with his money. Let me run you through the rate of return calculation, which Flipping NJ did 137 times in 2016. Our average sale period was 66 days. Therefore, you would make a profit of $27,000 on your $12,500 investment. It is a simple process and explains why competition is fierce in the wholesaling arena.

The fix and flip model is one step above wholesaling on the food chain. Instead of selling your prized possession to a ready, willing, and able buyer, you choose to fix and flip the property yourself. The “fix” may include anything from cosmetic landscaping; to new siding, windows, and roof; to a full interior renovation, with bathroom, kitchens, etc. remodeled, the whole enchilada. This approach takes more strategy, but it’s not difficult if you have a system. And, remember, the margins are greater—especially if you get into the two to four families or if you follow my thought process and dive right into big-deal thinking. Or do what I did, fly just below the radar of the monster players and feed off the crumbs that fall. Your mindset must be informed by understanding the abundance that exists.

If we’re honest, everyone’s dream is to be a big-time real estate developer, owning numerous income-producing multi-families, hitting the big leagues, and then retiring on an island—yippee! Well, it sounds great, and, trust me, it’s rewarding; however, most people spend a lifetime to get there. I, too, spent a fair amount of time struggling. My lack of confidence, incorrect approach, limited resources and mentors, and minimalistic outlook all played a part. But, why not benefit from my hard knocks and start your real estate investing career at the top. Take these techniques and stop playing small. Step up to the highest level and survey the potential opportunities: residential, multi-unit apartments, commercial office, retail on Madison Avenue, industrial parks, land development, and skyscrapers. Why set your target so low? If you ignore the larger targets, you’ll plunge into retirement with no money.

This is one of a series of articles based on my book, Modern Wealth Building Formula – How to Master Real Estate Investing. I have a passion for helping others secure their future. As the professionals say, “The best time to start is now!” Please follow me as I continue to give you insight and strategies for achieving your retirement dreams. We can do this together!